Fundamentals of Double Entry Accounting

As developers, we often find ourselves working on applications that handle money in various ways. Whether building a fintech application or integrating financial features into our startups, understanding the core principles of accounting is crucial. This is especially true when it comes to double-entry accounting, a system that has grown and improved over hundreds of years.

In this prelude, we’ll dive into the fundamentals of double-entry accounting, setting the stage for our more detailed exploration in the following parts of this series. Let’s break down the key concepts that form the foundation of this robust financial tracking system.

What is Double Entry Accounting?

Double-entry accounting is a method of bookkeeping that records each transaction in at least two different accounts. The core principle is simple yet powerful: every transaction must show both where the money came from (the source) and what it was used for (the use). This dual-aspect recording ensures that the books always balance, providing a clear and accurate picture of an entity’s financial state. If you’re new to accounting concepts, you might find our guide on What is a Subledger in Accounting? helpful for understanding how these principles are organized in practice.

The Accounting Equation

At the heart of double-entry accounting lies the fundamental accounting equation:

Assets = Liabilities + EquityThis equation represents the balance sheet of any entity and must always hold true. It’s the foundation upon which the entire double-entry system is built.

The way that transactions are entered into the accounting ledger ensures that this equation is always maintained. In the course of our blog post series we will see how this is true and also how a technical implementation of a ledger might look that maintains these rules.

Account Types: Debit Normal vs Credit Normal

In double-entry accounting, accounts are classified into two main types:

- Debit Normal Accounts: These represent funds you own or uses of money. Examples include assets and expenses.

- Credit Normal Accounts: These represent funds you owe or sources of money. Examples include liabilities, equity, and revenue.

This classification is important because it determines how transactions affect account balances.

Account Types: Balance Sheet accounts vs Profit and Loss accounts

Accounts are classified to be shown on either the Balance Sheet or the Profit and Loss statement in a very simple way:

- Revenues & Expenses are shown on the Profit and Loss statement

- Assets, Liabilities and Equity are shown on the Balance Sheet.

This means that the accounting equation from earlier is about the Balance Sheet. Stating it differently it says that the Balance Sheet must always balance.

Transactions and Entries

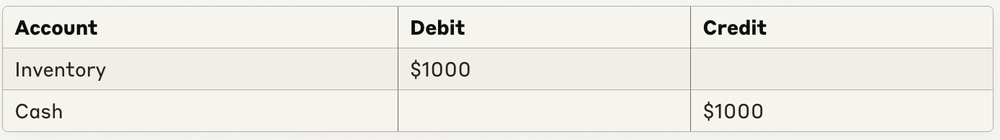

A transaction is an event that has a monetary impact and is recorded in the ledger. Each transaction consists of at least two entries, with each entry corresponding to an account. For example, when a company buys inventory with cash:

Transaction: Purchase inventory for $1000

Entry 1: Debit Inventory (Asset) $1000

Entry 2: Credit Cash (Asset) $1000

This transaction or journal entry as it is also called shows both the use of funds (increase in inventory) and the source of funds (decrease in cash).

It’s important that each journal entry needs to be “balanced”, i.e. the sum of all debits needs to be equal to the sum of all credits. We will soon see why.

Debits and Credits: More Than Just Additions and Subtractions

One of the most confusing aspects of double-entry accounting for newcomers is the concept of debits and credits. Contrary to common belief, these don’t simply mean additions and subtractions. Instead, they refer to the side of the account (left or right) on which an entry is recorded.

The effect of a debit or credit on an account’s balance depends on the account type:

For Debit Normal Accounts:

- Debits increase the balance

- Credits decrease the balance

For Credit Normal Accounts:

- Credits increase the balance

- Debits decrease the balance

This system ensures that the total debits always equal the total credits across all accounts, maintaining the balance in the accounting equation. Let’s look at why that is next.

The Balance Sheet always balances

The rules we have described above are already almost enough for the basical principles of accounting to work together. Let’s sumarise them and then introduce one more rule:

- debits and credits in each journal need to balance

- there are debit normal accounts and credit normal accounts

The new rule we will introduce is that the profit from the Profit and Loss Statement gets carried over to the retained earnings section in the Balance Sheet.

Profit = Revenues - ExpensesWhy is this important? This is important because it connects the Balance Sheet and the Profit and Loss statement. And why is that important? Because otherwise it would be possible for a valid journal entry to get your balance sheet to get out of balance. Let’s look into another example transaction.

Transaction: Pay rent

Entry 1: Debit Rent (Expense) $1000

Entry 2: Credit Cash (Asset) $1000If Entry 1 would not hit the balance sheet but only entry two would then Assets (cash) would decrease and no other balance sheet item would be touched. Thankfully the rent payment decreases profits in the P&L which in turn decreases retained earnings on the Balance Sheet through the new rule we just introduced and the Balance Sheet remains balanced.

In the next part, we’ll dive into the practical implementation of a double-entry accounting system, discussing data models, transaction immutability, and strategies for ensuring data consistency and integrity.

Related Articles

- Accounting for Developers - Continue to the next part of this series to learn about implementing these principles in code

- What Are Accounts Receivable? - Dive deeper into one specific aspect of the accounting system

- Accounting for First Time Founders: The Principles of Accounting - A practical guide to applying these concepts in a startup context