Accounts Receivable:- A Quick Primer

Accounts Receivable: A Quick Primer

Many businesses operate on credit, providing goods or services upfront and receiving payment later. To track these future payments, companies use an accounting tool called accounts receivable.

What are Accounts Receivable?

Accounts receivable represent the money customers owe a business for products or services already delivered. This amount typically appears as an asset on the company’s balance sheet and is a key component of accrual accounting.

Accounts receivable is money that the company expects to receive from customers within the next 12 months (but hopefully much earlier).

The Importance of Accounts Receivable

While a robust customer base is crucial, late or missing payments can severely impact a business’s cash flow. Effective management of accounts receivable is essential for maintaining healthy working capital and avoiding liquidity issues.

For most businesses there is a bit of a trade-0ff between revenues and and healthy accounts receivables. This is because companies often have a choice to offer more generous payment terms which will make it easier for them to sell more of their product or service but which will make it harder or at least slower to collect on the outstanding receivables afterwards.

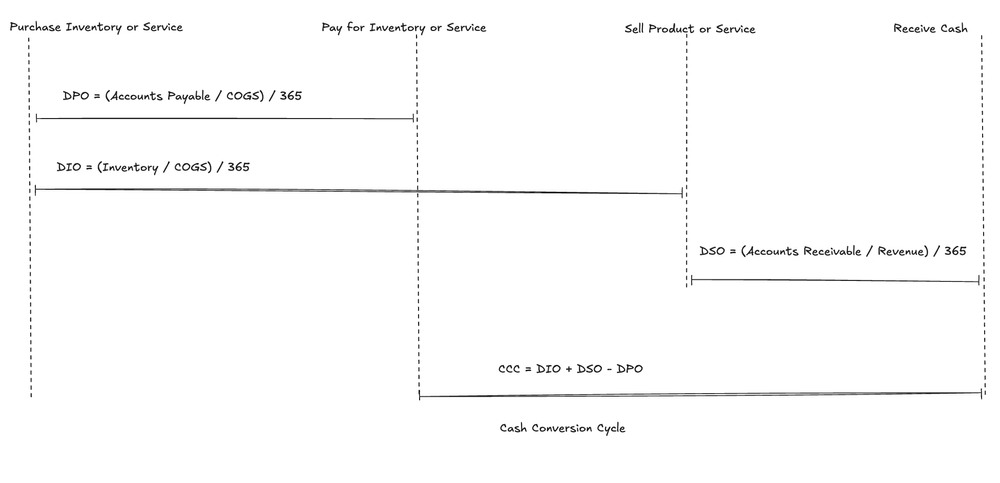

The Cash Conversion Cycle

Revenues only turn into cash when the company collects on its outstanding receivables.

The cash conversion cycle describes how a company uses working capital in order to deliver goods or services to their customers, then it invoices them creating outstanding accounts receivables and when it finally collects on them, the cycle has closed and the company has generated cash.

- Days Sales Outstanding (DSO)

- Days Inventory Outstanding (DIO)

- Days Purchases Outstanding (DPO)

- And CCC = DIO + DSO - DPI

There are some issues with these measures for example that they don’t reflect “real spending patterns” and that they are relying on a snapshot in time in the balance sheet among more problems. But they still help understand and think about the conversion of cash into working capital back, into accounts receivable and finally back into cash.

We have written a detailed article about the cash conversion cycle here.

Locating Your AR Balance

You’ll find your total accounts receivable under ‘current assets’ on your balance sheet. For a detailed breakdown by customer, consult your accounts receivable subsidiary ledger.

This is easy to do in Subledger through the contacts side menu item.

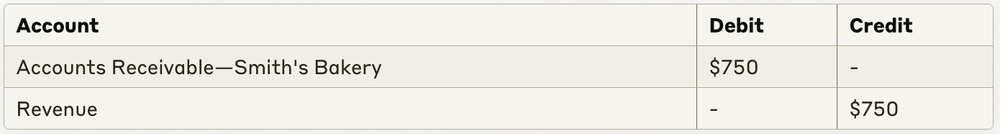

Accounts Receivable vs. Revenue

Although related, accounts receivable and revenue are distinct. When you invoice a client under accrual accounting, you simultaneously record both revenue and accounts receivable. For instance:

Debit: Accounts Receivable $750

Credit: Revenue $750This entry reflects a $750 invoice sent to Smith’s Bakery for consulting services.

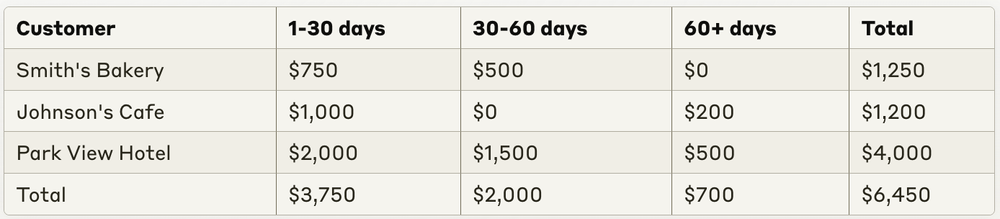

The Accounts Receivable Aging Schedule

To monitor payment timeliness, many businesses use an aging schedule.

Accounts Receivable Aging Schedule  Green Landscaping Inc., as of August 15, 2024

Green Landscaping Inc., as of August 15, 2024

Accounts Receivable vs. Accounts Payable

While both are important financial metrics, they serve opposite purposes. Accounts receivable is an asset (money owed to you), while accounts payable is a liability (money you owe others).

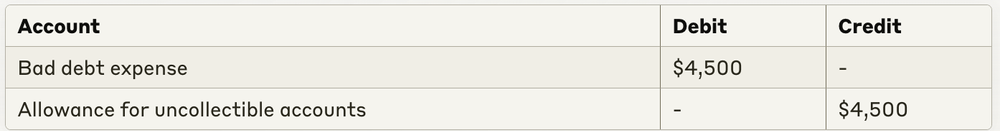

Preparing for Uncollectible Accounts

To account for potential non-payments, businesses may establish an “allowance for uncollectible accounts.” For example, if Green Landscaping Inc. expects $150,000 in annual sales with a 3% non-payment rate, they might make this entry:

Debit: Bad Debt Expense $4,500

Credit: Allowance for Bad Debts $4,500

Accounts Receivable Turnover Ratio

This ratio indicates how quickly customers pay. Let’s calculate it for Green Landscaping Inc.:

Beginning AR (Jan 1): $5,000 Ending AR (Dec 31): $3,000 Net Sales: $150,000

Average AR = ($5,000 + $3,000) / 2 = $4,000 AR Turnover Ratio = $150,000 / $4,000 = 37.5

To find the average payment period: 52 weeks / 37.5 = 1.39 weeks

This suggests Green Landscaping Inc.’s customers pay within 1.39 weeks on average.

Strategies for Faster Payments

- Implement a clear credit policy

- Offer multiple payment methods

- Provide early payment discounts

- Send regular reminders

Handling Non-Payment

If a customer consistently fails to pay:

- Consider suspending services

- Convert the receivable to a long-term note

- Engage a collection agency as a last resort

When Receivables Become Bad Debt

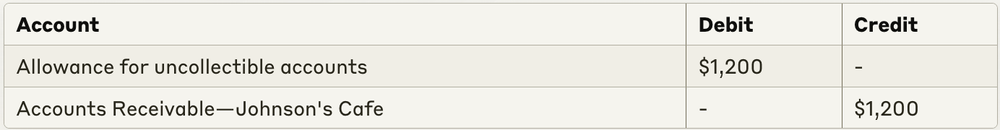

If it’s clear a customer won’t pay, you’ll need to write it off. For instance, if Johnson’s Cafe goes bankrupt owing $1,200:

Debit: Bad Debt Expense $1,200

Credit: Accounts Receivable $1,200

Accounting Standards for Receivables

Under GAAP, accounts receivable should reflect net realizable value. IFRS considers accounts receivable as current debt expected to be collected within a year.

The IRS allows businesses to deduct certain bad debts from gross income when calculating taxable income. Refer to the IRS Business Expenses guide for specifics on tax-deductible bad debts.

What Following GAAP and IFRS Rules means in Practice

Under GAAP

- Net Realizable Value: Under GAAP, accounts receivable must be reported at their net realizable value. This means: a. Recording the full amount of expected collections from customers. b. Establishing an allowance for doubtful accounts to estimate uncollectible amounts. c. Regularly reviewing and adjusting this allowance based on actual collection experience.

- Disclosure: Businesses must disclose their method for estimating uncollectible accounts in their financial statement notes.

- Timing: Revenue is recognized when earned, which often coincides with creating the accounts receivable.

Under IFRS

- Current vs. Non-current Classification: Under IFRS, receivables expected to be collected within one year are classified as current assets.

- Impairment Model: IFRS uses an “expected loss” model for bad debts, requiring companies to: a. Assess expected credit losses over the life of the receivable. b. Update this assessment at each reporting date.

- Fair Value: In some cases, receivables may need to be measured at fair value, especially if they’re part of a business combination.

Practical Implications

- Regular Review: Both standards require businesses to regularly review their accounts receivable and update estimates of collectibility.

- Documentation: Companies need robust systems to track aging of receivables and document their estimation processes for uncollectible accounts.

- Disclosure: Financial statements must include clear disclosures about accounts receivable policies and any significant judgments or estimates.

- Consistency: The chosen method for estimating uncollectible accounts should be applied consistently from year to year.

- Impact on Financial Ratios: The treatment of accounts receivable can significantly affect key financial ratios, such as the current ratio and days sales outstanding (DSO).

By understanding and effectively managing accounts receivable, businesses can maintain healthy cash flow and foster strong customer relationships.

Related Articles

- The Cash Conversion Cycle - Learn more about how receivables fit into your overall cash flow

- Understanding Different Types of Profits - See how accounts receivable impacts different profit metrics

- Income Statement Automation - Explore how to automate the management of receivables and other accounting processes