The Cash Conversion Cycle

The cash conversion cycle is a stylised model that helps explain how companies convert money into inventory with which they produce a product which in turn gets sold and converted into accounts receivable until they turn into cash when the company collects on it’s outstanding receivables.

It is usually formulated assuming a retail company that that buys and sells inventory but it applies equally to any other firm which requires goods or services and invoices it’s customers.

- Days Sales Outstanding (DSO)

- Days Inventory Outstanding (DIO)

- Days Purchases Outstanding (DPO)

The days sales outstanding measures the number of days worth of revenues that are outstanding to be collected.

Similarly, days payables outstanding measures the number of days worth of COGS that are outstanding to be paid.

And finally, days inventory outstanding measures the number of days worth of COGS that is held.

This comes from the relationship of economic stock and flow variables.

Together they form the cash conversion cycle: CCC = DIO + DSO - DPO

CCC describes the time it takes when the company pays for inventory for it to be turned around into cash received from the customer.

For example: DIO = 50 days, DSO = 40 days and DPO = 30 days

This means that the cash conversion cycle is CCC = 50 days + 40 days - 30 days. It means 60 days of operations are funded by the company which helps determine the working capital requirements.

A bit of intuition behind the numbers

- Day 0: Company receives inventory worth $1,000

- Day 30: Company pays supplier $1,000 for the inventory (DPO = 30 days)

- Day 50: Company sells the inventory for $1,100 (DIO = 50 days)

- Day 90: Company receives cash for the sale in full

This means that: From day 0 to 30 the supplier funds the company From day 30 to 50 the company has paid the supplier but holds the inventory so the company is funding the operation From day 50 to 90 the company is waiting for the cash from the sale so it is funding the operation

Which means that a total of 60 days (20 days + 40 days) are funded by the company and 30 days are funded by the supplier.

Real World Examples

Every company does this in a different way and the type of product or service the company produces and the way it does that determines much about it’s cash conversion cycle.

Some of the worlds fastest growing companies have very favourable working capital requirements. Some are able to finance a lot or even all of their operations through payment terms they have negotiated with their suppliers.

Walmart reported:

accounts payable of ca. $55.3 billion COGS of $429 billion for the their fiscal year ending Jan. 31, 2022. Using the DPO formula (DPO = (Accounts Payable / COGS) x 365), Walmart’s DPO for the fiscal year was approximately 47 days ($55.3 billion / $429 billion) * 365 days.

Derrivation of the Cash Conversion Cycle Formula

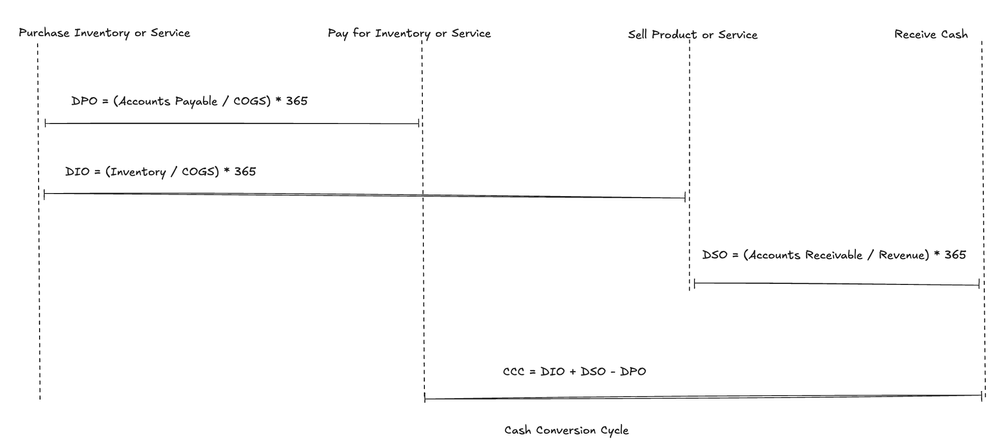

The formula for the cash conversion cycle CCC = DIO + DSO - DPO can be easily seen by looking at the little graphic above. The distance CCC is equal to the total distance (which is also DIO + DSO) minus DPO or CCC = DIO + DSO - DPO

Remember that CCC refers to the time in days that it takes a company from buying inventory to receiving cash from the customer. This is the distance labelled CCC in the graphic.

The time from Paying for Inventory or Service to Selling the Product is not labelled. It’s distance is CCC - DSOas can be seen from the graphic.

Let’s set CCC = CCC - DSO + DSO

The days sales outstanding measures the number of days worth of revenues that are outstanding to be collected.

Similarly, days payables outstanding measures the number of days worth of COGS that are outstanding to be paid.

The formulas are:

DSO = (Accounts Receivable / Revenue) x 365

DIO = (Inventory / COGS) x 365

DPO = (Accounts Payable / COGS) x 365

The cash conversion cycle is then calculated as:

CCC = DSO + DIO - DPO

How Working Capital Affects Profitability

Your Cash Conversion Cycle and management of Accounts Receivable directly impact your profitability at all levels. A efficient cash conversion cycle improves liquidity, reduces financing needs, and ultimately enhances bottom-line profits. Monitoring these metrics alongside your profit figures gives you a more complete picture of your business’s financial health.

Understanding the Impact on Profitability

The cash conversion cycle directly impacts your company’s profitability. A shorter CCC means more efficient use of working capital, which can improve your overall financial health. To understand how this affects different profit metrics, check out our guide on Understanding Different Types of Profits.

Related Articles

- What Are Accounts Receivable? - Dive deeper into this key component of the cash conversion cycle

- First-time Founder Series: Part 2 - Learn how to incorporate cash cycle considerations into your financial model

- Income Statement Automation - Discover how modern tools can help you monitor and optimize your cash cycle